On the topic of ‘how a producer-type manages their finances’ I thought it would be useful to share my process for preparing a tax return in Australia and —spoiler alert— how I prepare little parts through the year, so at tax time it’s just a matter of compiling them all… AKA how to make tax return preparation easier!

This comes with an enormous caveat that it is general information, and does not take into account your personal situation. This is not formal financial advice. It is being written for educational purposes only, in the spirit of sharing knowledge and process. It’s based on the Australian tax system because, well, I live in Australia.

For personal financial advice, you should find a qualified adviser to suit you and your goals. Or if you are facing financial hardship in Australia, try calling the National Debt Helpline on 1800 007 007 for free and confidential advice from professional financial counsellors.

With that out of the way, here’s how I handle my taxes.

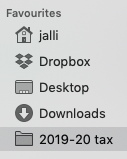

This assumes you have a computer, or access to one you’re comfortable saving personal financial information on, as you’ll need somewhere to store your files. I use Dropbox (a paid file storage system) to keep them all backed up, but it can just be a folder on the computer.

The folder setup

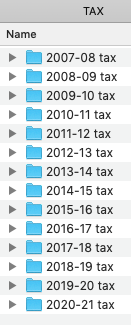

I keep everything in a folder called “TAX”. Classic.

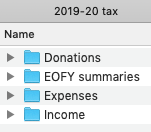

Within that, I’ve got a folder for each tax year. Here’s what that looks like.

This means my tax files for each year are packaged nicely together, and by using Dropbox I can ‘unsync’ old folders so they’re backed up to the cloud, but not taking up space on my computer.

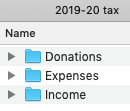

Within each tax year, I have a couple of subfolders, usually:

- Donations

- Expenses

- Income

Donations

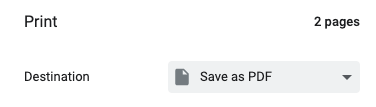

These are receipts for any donations I’ve made during that tax year, which might be the photograph taken on my phone (if it was a physical receipt), a PDF attachment from an emailed receipt, or a PDF of the email itself (by going to Print and then ‘Save as PDF’).

Once saved to this folder, I delete the email. This is part of my Inbox Zero process: a whole other (but related!) thing.

Here’s a video (4min) where I take you through my process for compiling donation info, and how this can help make tax return preparation easier at the end of the tax year:

Here’s what’s covered:

00:43 Tax folder shortcut

00:58 File/folder setup

01:10 Tax summary (Google Sheet)

01:55 Example email receipt (PDF file)

02:37 Adding a demo donation to the summary sheet

Expenses

These are receipts for any money I’ve spent for work-related purposes (that is, things I’ve purchased for myself and not been reimbursed for by my employer).

What you can consider a ‘work expense’ will vary wildly depending on what you do for work, but mine includes things like:

- Mobile phone bills

- Hardware, if I have purchased a new phone, computer or monitor in that tax year

- Software, like Dropbox or Adobe CS

- Website domain registration and hosting costs

- Home office expenses, like electricity and home internet bills

- Computer or phone accessories, such as cases, headphones, chargers, adaptors or mousepads

- Professional development, if I have paid for any work-related reading materials, or courses

- Travel costs, when appropriate

- Any costs associated with managing my tax affairs (such as invoices from my accountant)

The ATO is the best source of up to date information about what you can or can’t claim in Australia.

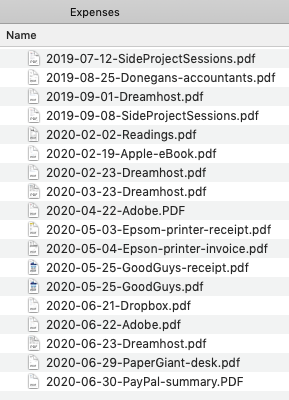

I rename my files in the format: YYYY-MM-DD-CompanyName.PDF so they’re always in chronological order (by date purchased), and so I can cross check by company name (i.e. who I purchased from)… but this is pretty next level, and honestly just getting them into the folder for most people would be enough.

Once these expense receipts are in this folder, I delete the email, if there was one (again, see Inbox Zero for more on this).

Pro tip: If you’re on your own computer, you can create a shortcut to the current tax year folder in your Finder sidebar (on Mac) or pin to your Quick Access list (on PC) to make it easy to quickly throw files in, to be sorted and organised later (even if this is at tax time!).

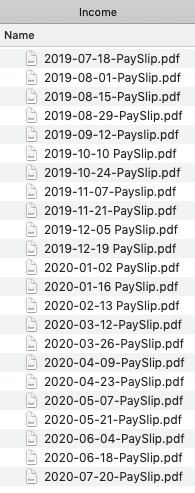

Income

Since I work for an employer, this is where I save my payslips.

In my case, these are attached as PDFs to an email every fortnight when I get paid. Once I’ve saved my payslip to this folder… yep, you guessed it: I delete the email (final plug here for my Inbox Zero post).

If you do any freelance work, then the invoices you’ve sent might live here (perhaps in their own folder if you have both a salary job and freelance on the side).

As an aside, I probably don’t need to keep all of these payslips on file as I can access them via Xero (my employer’s accounting software) and an income statement or payment summary via MyGov at the end of the year, but —because of the type of person I am— I like to keep my own records in case I ever lose access to the other systems and want to check something. I don’t need to do this often (if at all), so this might belong in the category of “things I do, that you don’t need to” 🤷

EOFY summaries

After the end of the financial year (which is July in Australia), I add a new subfolder for “EOFY summaries”.

This is where I put things like my:

- Income statement from my employer (via MyGov)

- Summary of cover from my health insurer

- Interest and tax summary from my bank

- Share statements (if you own shares, these include an interest and estimated dividend summary, transaction summary, portfolio valuation, and financial year summary)

The process

So here’s the thing: the folder setup is the process. By having a place to put relevant files throughout the year, my only task at the end of the year is to make sure all the correct info is in the tax folder, then give it all to my accountant (or use to lodge my own return).

For the final compilation, I have a spreadsheet template setup so I can grab the details from my files and put them in the relevant tab.

Each tab is matched to a section of the tax return and based on what’s relevant to me:

- Income:

- Salary or wages

- Dividends

- Deductions

- D2 Work related travel expenses

- D4 Work related self-education expenses

- D5 Other work related expenses

- D9 Gifts or donations

- D10 Cost of managing tax affairs

For example, I don’t have work-related car expenses or work-related clothing, laundry and dry cleaning expenses, so my spreadsheet doesn’t have any tabs for calculating these.

Again, this is an extra step that I find helpful for tallying things up and making sure nothing is missed, but if you’re not so spreadsheet-happy then you could just add things up with a calculator during lodgement, or leave it for your accountant to do.

The disclaimer

I’m aware that this whole process is suited to my (project manager!) personality and specific to my employment circumstances (and the Australian system), but over the years I’ve been refining how I manage my tax to a point where it doesn’t stress me out like it used to.

When people ask me how I do it, I’ve tended to give them my spreadsheet template but now realise that sharing the process is far more useful. I hope I’ve been able to explain it in a way that could help someone make their tax returns less stressful too.

As mentioned at the top, this is general information, and does not take into account your personal situation. This is not formal financial advice. It was written for educational purposes only, in the spirit of sharing knowledge and process.

For personal financial advice, you should find a qualified adviser to suit you and your goals. Or if you are facing financial hardship in Australia, try calling the National Debt Helpline on 1800 007 007 for free and confidential advice from professional financial counsellors.